Your If i withdraw from my 401k for home images are ready. If i withdraw from my 401k for home are a topic that is being searched for and liked by netizens now. You can Get the If i withdraw from my 401k for home files here. Get all royalty-free images.

If you’re looking for if i withdraw from my 401k for home pictures information linked to the if i withdraw from my 401k for home interest, you have visit the ideal site. Our website always gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

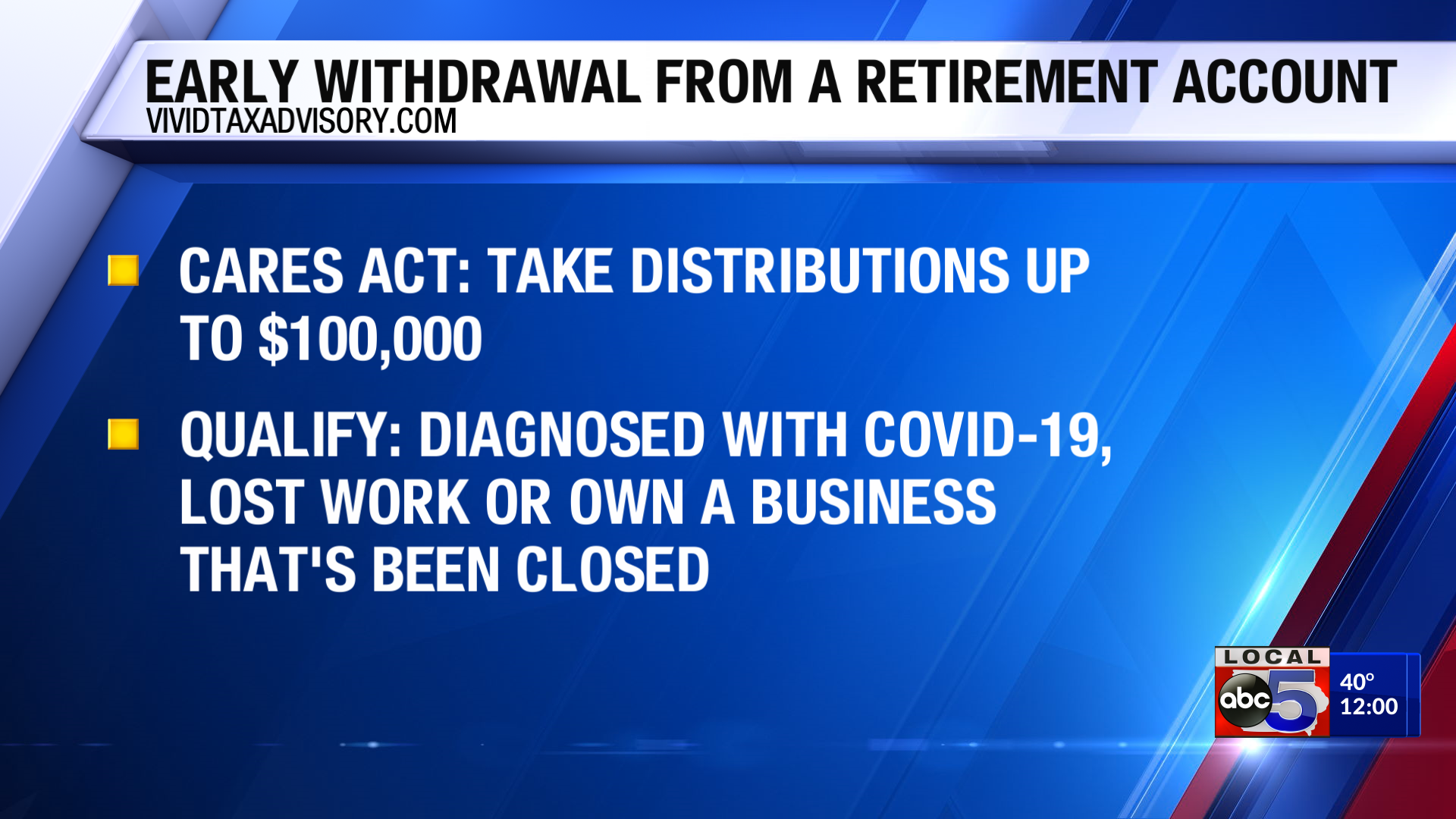

If I Withdraw From My 401k For Home. However you can withdraw your savings without a penalty at age 55 in some circumstances. If you havent reached the age of 59 ½ years at the time of distribution you may be liable to pay a premature withdrawal penalty of 10 subject to certain exceptions. But while IRAs allow you to withdraw funds for homebuying purposes 401k plans do not. Theres no specific penalty exemption for home purchases when you pull money out of a 401k so any money you take out will be classified as a hardship exemption.

Pin On Money Earning From in.pinterest.com

Pin On Money Earning From in.pinterest.com

Paying Back a 401k Loan. Using Your 401k for a Down Payment. According to the IRS the safe harbor hardship withdrawals from a 401k plan are limited to. I am still able to save about 9000year in 401k. The rules for IRAs are different than those for a 401 k and are more favorable to first time homebuyers. Choosing either route has major drawbacks such as an early withdrawal penalty and losing out on tax.

If you havent reached the age of 59 ½ years at the time of distribution you may be liable to pay a premature withdrawal penalty of 10 subject to certain exceptions.

According to the IRS the safe harbor hardship withdrawals from a 401k plan are limited to. First-time home purchases or new builds may also be considered eligible for a hardship withdrawal from your 401k. Youll be assessed a penalty of 10 on the amount withdrawn and youll have to. Paying Back a 401k Loan. If you remove money from your 401k to purchase a home youll face the aforementioned penalty. Any amount borrowed from your 401k must be paid back within five years.

Source: pinterest.com

Source: pinterest.com

Many 401k or IRA retirement plans include a hardship withdrawal clause that the individual can access. It was a cheap way to borrow money says Ashley. I just refinanced my home at 3375 and would consider renting it out for 2-3 years until the market rebounds a little more in this area. That is true as long as the amount withdrawn. We had just purchased the.

Paying Back a 401k Loan. When you leave your employer and return to your home country you can also cash out your 401 k. Most of the time anyone who withdraws from their 401k before they reach 59 ½ will have to pay a 10 penalty as well as their regular income tax. Choosing either route has major drawbacks such as an early withdrawal penalty and losing out on tax. Look at the pros and cons 401k withdrawals Depending on your situation you might qualify for a.

Source: in.pinterest.com

Source: in.pinterest.com

You can withdraw funds or borrow from your 401 k to use as a down payment on a home. The rules for IRAs are different than those for a 401 k and are more favorable to first time homebuyers. Look at the pros and cons 401k withdrawals Depending on your situation you might qualify for a. It is not the best move however because there is an opportunity cost in doing so. Youll be assessed a penalty of 10 on the amount withdrawn and youll have to.

Source: cmpfinancial.com

Source: cmpfinancial.com

However unlike 401ks there is not a 10 penalty to withdraw money from an IRA to put toward a down payment on a home. Paying Back a 401k Loan. Most of the time anyone who withdraws from their 401k before they reach 59 ½ will have to pay a 10 penalty as well as their regular income tax. It is not the best move however because there is an opportunity cost in doing so. What do I need to consider to determine if this is a good idea.

Source: reviewjournal.com

Source: reviewjournal.com

The short answer is yes you are allowed to use funds from your 401k plan to buy a home. For example if you must put 10000 down on a home to purchase it you may be able to withdraw 10000 from your 401K. The purchase of a primary residence. Again the 10 penalty will still likely apply here. A withdrawal permanently removes money from your retirement savings for your immediate use but youll have to pay extra taxes and possible penalties.

Source: pinterest.com

Source: pinterest.com

A withdrawal permanently removes money from your retirement savings for your immediate use but youll have to pay extra taxes and possible penalties. The money doesnt have to be repaid and youre not limited in the amount you can withdraw which is the case with a 401 k loan. Many 401k or IRA retirement plans include a hardship withdrawal clause that the individual can access. The funds you take. For example if you must put 10000 down on a home to purchase it you may be able to withdraw 10000 from your 401K.

Source: myrawealth.com

Source: myrawealth.com

That is true as long as the amount withdrawn. I am still able to save about 9000year in 401k. Look at the pros and cons 401k withdrawals Depending on your situation you might qualify for a. First-time home purchases or new builds may also be considered eligible for a hardship withdrawal from your 401k. We had just purchased the.

Source: pinterest.com

Source: pinterest.com

A hardship withdrawal from a 401k for home repair is subject to income tax as well as the 10 withdrawal penalty if you are younger than 59 ½. Money used to pay certain medical expensesfor you your spouse or any of your dependents. Payments of specific post-secondary education expense for the next year for you your spouse or any of your dependents. When paying off a 401k loan the money for payments will be deducted directly from your paycheck. However unlike 401ks there is not a 10 penalty to withdraw money from an IRA to put toward a down payment on a home.

Source: pinterest.com

Source: pinterest.com

You can withdraw funds or borrow from your 401 k to use as a down payment on a home. The purchase of a primary residence. A hardship withdrawal from a 401k for home repair is subject to income tax as well as the 10 withdrawal penalty if you are younger than 59 ½. It is not the best move however because there is an opportunity cost in doing so. Other than mortgage my only major expense is 25000 tuition for my daughter who is just entering her 2nd year.

It is not the best move however because there is an opportunity cost in doing so. You cannot be a current employee of the company that runs the 401k and you must have left that. If you remove money from your 401k to purchase a home youll face the aforementioned penalty. However you can withdraw your savings without a penalty at age 55 in some circumstances. According to the IRS the safe harbor hardship withdrawals from a 401k plan are limited to.

Source: pinterest.com

Source: pinterest.com

We had just purchased the. The money you withdraw from your 401K must be used specifically for the down payment. But while IRAs allow you to withdraw funds for homebuying purposes 401k plans do not. The purchase of a primary residence. Look at the pros and cons 401k withdrawals Depending on your situation you might qualify for a.

Source: pinterest.com

Source: pinterest.com

I just refinanced my home at 3375 and would consider renting it out for 2-3 years until the market rebounds a little more in this area. The rules for IRAs are different than those for a 401 k and are more favorable to first time homebuyers. You cannot be a current employee of the company that runs the 401k and you must have left that. Most of the time anyone who withdraws from their 401k before they reach 59 ½ will have to pay a 10 penalty as well as their regular income tax. A withdrawal permanently removes money from your retirement savings for your immediate use but youll have to pay extra taxes and possible penalties.

When paying off a 401k loan the money for payments will be deducted directly from your paycheck. As a first time buyer you can withdraw up to 10000 from an IRA without paying any. First-time home purchases or new builds may also be considered eligible for a hardship withdrawal from your 401k. Borrowers must understand that taking a 401k loan carries with it the. A withdrawal permanently removes money from your retirement savings for your immediate use but youll have to pay extra taxes and possible penalties.

Source: pinterest.com

Source: pinterest.com

If you remove money from your 401k to purchase a home youll face the aforementioned penalty. The money doesnt have to be repaid and youre not limited in the amount you can withdraw which is the case with a 401 k loan. Borrowers must understand that taking a 401k loan carries with it the. A withdrawal permanently removes money from your retirement savings for your immediate use but youll have to pay extra taxes and possible penalties. Other than mortgage my only major expense is 25000 tuition for my daughter who is just entering her 2nd year.

Source: pinterest.com

Source: pinterest.com

The 401k Withdrawal Rules for People Between 55 and 59 ½. Again the 10 penalty will still likely apply here. The short answer is yes you are allowed to use funds from your 401k plan to buy a home. Look at the pros and cons 401k withdrawals Depending on your situation you might qualify for a. If you havent reached the age of 59 ½ years at the time of distribution you may be liable to pay a premature withdrawal penalty of 10 subject to certain exceptions.

Source: ally.com

Source: ally.com

A withdrawal permanently removes money from your retirement savings for your immediate use but youll have to pay extra taxes and possible penalties. The rules for IRAs are different than those for a 401 k and are more favorable to first time homebuyers. The 401k Withdrawal Rules for People Between 55 and 59 ½. Withdrawing from a 401 k isnt as easy as it seems though. If you remove money from your 401k to purchase a home youll face the aforementioned penalty.

Source: wusa9.com

Source: wusa9.com

Choosing either route has major drawbacks such as an early withdrawal penalty and losing out on tax. Lets look at the pros and cons of different types of 401k loans and withdrawalsas well as alternative paths. Read full question. Look at the pros and cons 401k withdrawals Depending on your situation you might qualify for a. I am still able to save about 9000year in 401k.

Source: pinterest.com

Source: pinterest.com

It was a cheap way to borrow money says Ashley. Most of the time anyone who withdraws from their 401k before they reach 59 ½ will have to pay a 10 penalty as well as their regular income tax. I just refinanced my home at 3375 and would consider renting it out for 2-3 years until the market rebounds a little more in this area. Borrowers must understand that taking a 401k loan carries with it the. Theres no specific penalty exemption for home purchases when you pull money out of a 401k so any money you take out will be classified as a hardship exemption.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title if i withdraw from my 401k for home by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.